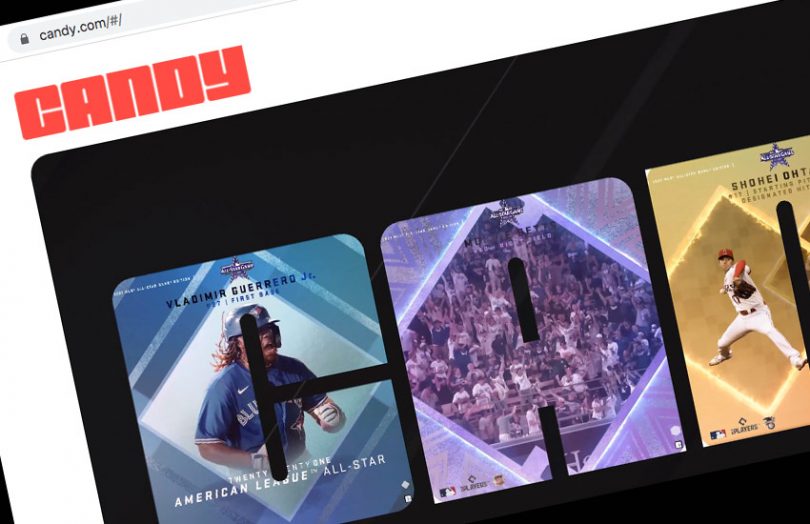

Today Candy Digital said it completed a $100 million Series A investment at a $1.5 billion valuation. The firm was founded earlier this year as a non-fungible token (NFT) joint venture between sports ecommerce firm Fanatics, Galaxy Digital and Gary Vaynerchuk, with Fanatics holding the majority share. Since then, it has signed an NFT deal with Major League Baseball (MLB).

The funding round was co-led by Insight Partners and Softbank Vision Fund 2, with participation from Connect Ventures, the joint venture between sports agency CAA and New Enterprise Ventures. There were several other backers, including current and retired athletes such a Peyton Manning.

“Blockchain and NFTs provide tremendous opportunities to enhance the fan experience by allowing people to own a piece of their passion,” said Scott Lawin, CEO of Candy Digital. “We’re thrilled to continue partnering with the leading sports leagues around the world to engage fans through the next generation of sports collectibles as we create the future of fandom together.”

Apart from the MLB, where the company has started to roll out NFT offerings, it also has deals with the Major League Baseball Players Association (MLBPA), the Race Team Alliance (RTA) and several college athletes. Earlier this year, the NCAA relaxed the rules around college students earning money from their image following a legal challenge.

“By combining Fanatics’ proven track record with blockchain and NFT expertise, we believe Candy Digital is creating a leading platform that offers consumers the opportunity to own a unique digital asset,” said Lydia Jett, Partner at SoftBank Investment Advisers.

Meanwhile, with its 80 million customer base, Fanatics has started branching out beyond licensed merchandise, launching a digital sports platform including Candy Digital for NFTs as well as trading cards, online betting, and iGaming.

On the topic of trading cards, in August, Fanatics landed several massive trading card deals, including with the MLB, MLBPA, NBA, NBPA, NFLPA, but not with the NFL. The moves ended multi-decade deals with existing partners such as Topps 70 year MLB relationship.