On Thursday, the Wall Street Journal (WSJ) reported that the player’s unions of Major League Baseball (MLB), the National Football League (NFL), and the National Basketball Association (NBA) had inked trading card deals with licensed sports apparel retailer Fanatics. Additionally, it claims the NBA and MLB leagues (but not the NFL) have also entered into collectibles agreements, citing sources.

Fanatics’ website says it’s “building the leading global digital sports platform.” It has a non-fungible token (NFT) joint venture, Candy Digital, with Mike Novogratz’s blockchain merchant bank Galaxy Digital as well as Gary Vaynerchuk. Before the latest news, Candy had already inked an NFT deal with MLB beyond conventional trading cards. The retailer is the major shareholder in Candy (more below), and it’s hard not to see the role of the NFT boom in this flurry of deals. Physical sports collectibles haven’t suddenly become more valuable. NBA Top Shot’s cumulative $689 million in NFT sales has something to do with reinvigorating the collectibles market.

In an email to members, Tony Clark, executive director of the MLBPA, said that the player association’s deal is ten times the amount of anything it’s ever done previously. Last year the MLBPA earned $20.4 million from collectibles firm Topps.

After lost MLB rights, Topps’ SPAC deal abandoned

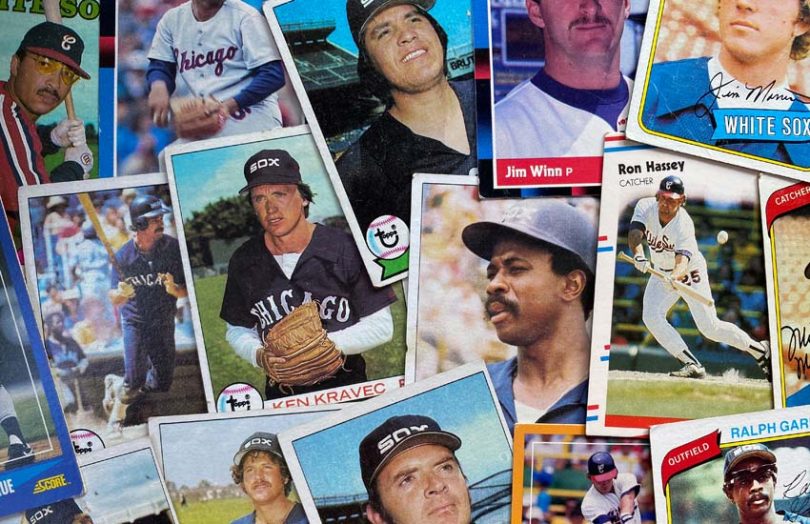

Sports collectible company Panini had the rights to NBA and NFL, and Topps has published MLB collectible cards for 70 years. It planned to list on the NASDAQ through a merger with a SPAC vehicle Mudrick Capital, but that was abandoned on Friday.

In an announcement about the SPAC, the company said, “Topps expects to be able to produce substantially all its current licensed baseball products through 2025, pursuant to its existing agreements.” The MLB Players Association (MLBPA) deal starts in 2023, but the league one will start later. The NBA and NFL player association deals will be until 2025 and 2026.

“Not only were we unaware that Major League Baseball was negotiating with anybody other than Topps regarding our rights beyond 2025,” said Topps chairman Andy Redman according to Sportico, “but we were abruptly informed [last Thursday by] MLB that a deal was completed, finalized and exclusive with Fanatics.”

Both Sportico and the WSJ reported that all the associations – NBAPA, MLBPA, NFLPA, MLB, NBA, will get an interest in the joint venture with Fanatics, which we believe is separate from Candy, the digital joint venture.

Fanatics already both manufactures jerseys and apparel for multiple leagues, apart from its extensive sports retail activities, as well as a deal with Walmart. Earlier this month, it was reported that Fanatics raised $325 million at an $18 billion valuation, including funds from existing backers SoftBank and Silver Lake.

Candy: will sports take blockchain mainstream?

Talking about taking blockchain to a broader market, Scott Lawin, Candy Digital CEO, said that “sport in many ways is kind of the gateway drug for the mass market,” talking to Ledger Insights a few days before this news broke.

Lawin harks from Galaxy Digital, founded by one of Candy’s board members Mike Novogratz and is one of the most well-recognized cryptocurrency institutional fund managers.

Despite the hype surrounding cryptocurrencies and NFTs over the last few months, blockchain-based products, even those targeted at mainstream audiences, still mostly attract a very exclusive community of crypto enthusiasts.

“To move from the crypto community and DeFi space into a broader mass market adoption, sports was really the content vertical that made the most sense,” said Lawin.

Sports leagues already have an established loyal fanbase and access to a global market of customers looking for ways to interact with their favorite team and players. Many younger fans that grew up in a digital world are also looking for more innovative and screen-based solutions to participate in the sports community.

Compared to many offerings in the sports NFT space, Candy is looking to distance itself from digital lottery-like products. It wants long-term partnerships and to develop blockchain-based products that live beyond the initial hype.

The partnership with Fanatics provides access to its established sports customer base and allows Candy to differentiate its product by associating digital assets with Fanatics’ physical asset deals, such as sports jerseys. And now baseball cards as well.

Lawin spoke about the three iterations of collectible cards, from the original cardboard card to a digital version of that card and then collectibles 3.0, which is ‘everything else’.

Beyond linking digital and physical products, it is exploring how fans can track a team or player’s performance through a digital asset and other types of engagement. “We’re really focused on building out a universe of assets that tie people back to the sport in a more direct way,” said Lawin.