RiskBlock the insurance industry alliance, has ambitious plans for an open ecosystem for the whole insurance sector. Later this summer they plan to launch the second version of their Canopy blockchain system to enable third parties to connect into their network and build applications on top.

While the vision is big, so is the financial potential. One application to be released later this year could save up to $300m annually in the US.

Today The Institutes RiskBlock Alliance boasts 28 members, including most of the biggest names in insurance in the US such as State Farm, Liberty Mutual, GEICO, Nationwide, USAA, Chubb, and Travelers.

LEGO set of blockchains

The core idea that underpins the Canopy framework is a set of standardized blockchains. So there is one policy blockchain and one claims blockchain. They want to avoid reinventing the wheel for every new use case or application, and all use cases will need policies and claims. So any other blockchain or application will use these core blockchains.

That doesn’t mean that the entire industry’s policies will be stored on every RiskBlock node or server. With their recent adoption of R3’s Corda technology, a company’s node will only store policies with which they’re involved.

On top of the core framework, they have a layer of security and tools to help others to build on Canopy. This means vendors can create solutions that plug into the ecosystem. Additionally, it enables carriers to develop proprietary applications that use the policy blockchain and share data amongst themselves.

Christopher McDaniel, RiskBlock’s Director, spoke to Ledger Insights about his vision. “Our whole point with Canopy is NOT that we’re the only ones that are going to build applications on top of Canopy. We want to build an open ecosystem where anybody can plug in.”

“We want to make it an open framework for the insurance industry. And since we’re a not-for-profit, there’s no profit motive for us to make it proprietary. We want to do what’s best for the industry. And frankly, what’s best for the industry is having one framework that everybody plugs into.”

The entire insurance industry?

RiskBlock isn’t the only industry alliance. There are several local and specialist ones, but Switzerland-based B3i is the other substantial group. B3i’s initial focus is on reinsurance, though they have broader plans which also encompasses an ecosystem.

So as of today the two hardly overlap, but they will soon.

At the recent Blockchain fo Insurance summit, each group positioned itself as global. But each perceives the other as regional.

This year RiskBlock is setting up RiskBlock Canada, RiskBlock UK, and RiskBlock Asia. B3i recently appointed a North American representative. The two groups also have some overlapping members.

McDaniel’s view is that Canopy is intended as an open ecosystem for anybody to plug in, and that includes B3i. The fact that both groups have switched to R3’s Corda makes the potential for interoperability easier.

For now, B3i has a dual focus, firstly to close its funding round. And secondly, to launch its Cat XOL reinsurance contract on its blockchain platform this year.

Systemic risk

If there are only one or two large blockchain frameworks is that a potential systemic risk for the insurance industry? What if there’s a serious bug in the policy blockchain that gets implemented across the entire industry?

It’s a tough one to address, but European regulators have started to raise questions like this about blockchain for the banking industry.

There’s another regulatory question which all major blockchain consortia might face: what’s the difference between a consortium and a cartel?

The evolution of the Canopy Framework

McDaniel left Deloitte to head up RiskBlock when it started in 2017. To be able to move quickly, he came up with the idea of a ‘Software Factory’. The factory is made up of five major consultancies which are Deloitte, IBM, Cap Gemini, Accenture, and EY.

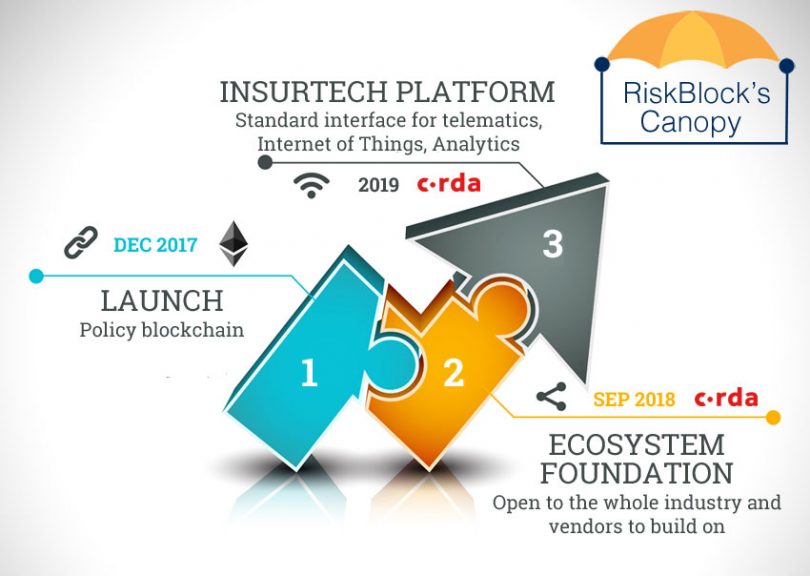

Deloitte built the first version of Canopy which launched at the end of last year. It was primarily focused around the early use cases. Deloitte is still very much involved in building many of the core services as well as use cases.

The second Canopy version is far more standardized and reusable and targeted for release in early September. Accenture is the Lead Framework Architect.

In the Fall RiskBlock plans to start work on version three which aims to provide standard interfaces for insurtech technologies. So interfaces for telematics, Internet of Things, and a standard way to extract data for analytics.

Use cases

Two applications will launch together with Canopy Two: Proof of Commercial Insurance and First Notice of Loss for claims.

A little later in the year, RiskBlock will unveil a Subrogation application for insurers to negotiate claims between each other. This is the application that could save a large part of the $300m annual costs of Subrogation.

The alliance plans a parametric blockchain for later in the year which is more of an enabler than an application. The intention is to create a blockchain which has a single source of truth for parametric data such as weather, wind, and earthquakes.

For example, if there’s a flood in Miami an insurer could check the blockchain for how much rain fell at a particular zip code to see whether that will trigger an automatic payout on a client’s policy.

When asked about insurers’ interest in business model innovation like parametric insurance, McDaniel stated there was so much low-hanging fruit for cost savings that this is where the focus is likely to be for the next 2-3 years.

A few insurers are even eyeing blockchain to replace part of their legacy back-office systems entirely.

Expansion plans

So far RiskBlock has focused on Property and Casualty. In just a few days they will open up for Life, Annuity, and Retirement insurance members and McDaniel expects to welcome twenty companies. They’ve already run labs and have a list of use cases, most of which relate to agents and distributors.

On top of that they’re also considering workers compensation and group health insurance as potential target sectors.

Combined with the international plans, that’s a whirlwind of expansion. But the one thing to keep an eye on will be the unveiling of Canopy Two in September. That’s the foundation of a potentially massive ecosystem.