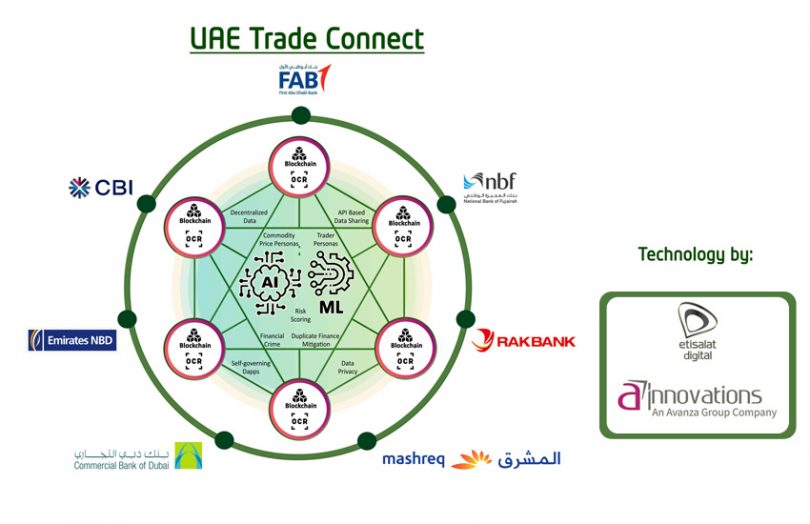

On Tuesday, UAE Trade Connect (UTC) held a press conference for the production launch of the trade finance blockchain system. The network was first announced in mid-2019 by Etisalat Digital and First Abu Dhabi Bank (FAB) with Avanza Innovations as the developer. There are now seven banks that all participated in the platform’s development and another four banks are starting pilots.

While there was a little reluctance to provide specific figures about the solution’s potential, it’s possible it could process 200 – 250 billion dirham of domestic trade ($55-$68 billion) annually.

The founding banks are First Abu Dhabi Bank, Emirates NBD, Commercial Bank of Dubai, Mashreq, National Bank of Fujairah, RAKBANK and Commercial Bank International and the central bank has been on the steering committee since 2020. With 48 banks in the UAE, it hopes to become a national network with international banks participating.

UTC’s first solution addresses fraud by anonymously sharing data between banks without seeing each other’s underlying data. Typically, there are four types of fraud: false invoicing, duplicate invoicing, over pricing, and using the funds for non-trade purposes. UTC’s blockchain solution particularly addresses duplicate invoicing, but Etisalat also runs machine learning across the invoices, which over time will help identify pricing irregularities and potentially false invoicing.

These sorts of solutions need as many member banks as possible because they will only detect double financing between participants. Savvy fraudsters will get funding from one of the consortium participants and then target non-members for additional financing.

While the platform isn’t purely targeted at SMEs, Reda Ezzat, Head of Trade & Structured Finance at Mashreq, emphasized the importance to the SME sector. Many smaller businesses are unknown quantities which raises the risk for banks. UTC helps to address risks and hence “banks can start to get a better risk appetite, so the technology made available by the UTC will definitely affect their ability to support or give access to finance to SMEs,” said Ezzat.

Globally, SMEs account for 90% of businesses and 40% of GDP in the developing world, with the UAE having similar figures.

A roadmap & how it works

However, addressing the risk of fraud is just the first step in a longer roadmap. Next up is targeting other financial crime risks such as trade based money laundering and sanctions busting. After that, the consortium will consider e-invoicing, e-bills of lading, letters of credit and bank guarantees. It also hopes to integrate with other international networks such as we.trade, komgo, Marco Polo, Contour and eTrade Connect. For example, National Bank of Fujairah is a member of Marco Polo.

In terms of how it works, each of the banks hosts their own blockchain node with their own data in the Etisalat cloud. The solution uses the Hyperledger Fabric enterprise blockchain. To share an invoice or funding between banks, a hash or fingerprint of the data is shared between the banks. That means they can’t see the client or the transaction details from another bank.

While the data shared via the blockchain is not identifiable, invoicing and financing are also used for machine learning. We’ve asked for more details and will update the article with a response.

Meanwhile, there are numerous other blockchain activities in the UAE, some of them announced this week. For example, some of the UTC banks are participants in the UAE Know Your Customer (KYC), which went live in the middle of 2020.