Australian payments company eftpos has joined the Governing Council of Hedera Hashgraph’s decentralized public network and will run the country’s first node. The company is the 17th entity to join Hedera’s Council, including Google, IBM and LG Electronics as members. The news is a massive win for the DLT network, but the token price spiked before the announcement, repeating behavior before Google joined.

Nineteen firms own eftpos, including Australia’s biggest banks Commonwealth Bank of Australia, Westpac, ANZ and National Australia Bank. The organization operates Australia’s debit card processing system and recently acquired ‘Beem It’, a mobile payments app. Eftpos processed over two billion transactions in 2020 at an average of more than $300 million a day.

Debit cards have become the most popular payment choice in Australia. In 2019, debit payments accounted for 44% of all consumer payment methods, and in 2020 they accounted for 70% of the monthly electronic payments.

Key drivers behind eftpos’ interest in Hedera are micropayments for small online payments or device to device transactions, including stablecoins. Hence before becoming a Hedera Governance member, eftpos ran Proofs of Concept (PoCs).

“By combining the new eftpos API infrastructure with a consumer wallet-based experience, digital identity, and an AUD-based stablecoin using Hedera’s superfast, secure and low-cost distributed network, the PoC’s objective was demonstrably achieved,” said Rob Allen, eftpos Entrepreneur in Residence. “Use cases like this simply are not possible on other public blockchains. Along with several partners, we are now exploring a variety of use cases that this combination of technologies enables and the options to commercialise them.”

Spike in token price

Hedera Hashgraph has numerous strengths, including its unique technology and its Governance Council dominated by large enterprises. However, given the latter, there’s a higher bar for its activities.

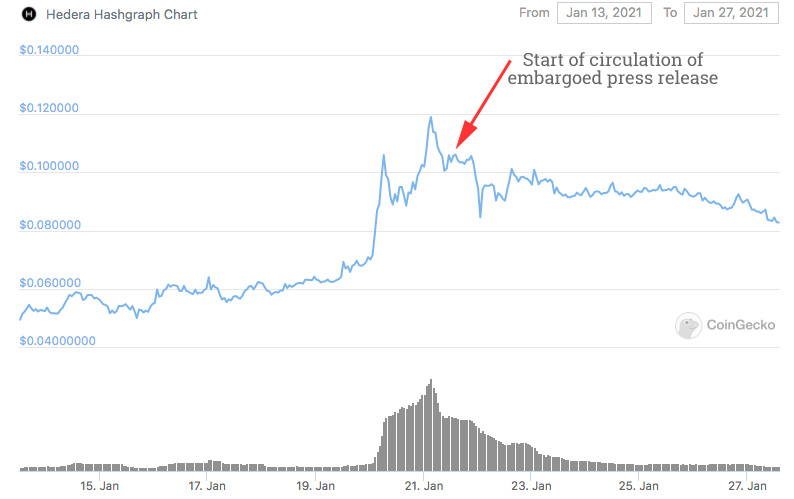

The price of Hedera’s token HBAR spiked in advance of major news. We noted the same behavior before the announcement of Google joining the Governing Council.

Various cryptocurrencies have been pursued by the SEC for issuing tokens that are securities, the biggest being Ripple and XRP.

Most news is not especially sensitive, but the eftpos news is important because it indicates potential adoption by banks.

The embargoed news release started to circulate on the afternoon of January 21st, by which time, as the graph indicates, the price had already spiked. Many cryptocurrency prices are correlated, and while HBAR spiked by 70%, Bitcoin’s price remained flat.

If token issuers don’t self regulate, governments will do it for them.

Meanwhile, before eftpos, the last entity to join Hedera’s Council was law firm Dentons. The Hedera network is host to various projects across eleven industries, including the development of solutions to monitor the temperature of Covid-19 vaccines storage rooms, and in the development of blockchain technology that verifies government-issued records. In addition, FIS, another payment service provider, is also on the Council.