Consulting firm Bain & Co recently published a report outlining its strategy thoughts for incumbents addressing the digital asset space.

Bain identifies the three sectors that offer the best digital asset opportunities as the private markets for equities, bonds and real estate. The attraction isn’t just the significantly larger size of the private markets, but the compound growth rate is four times that of public markets over the past 20 years.

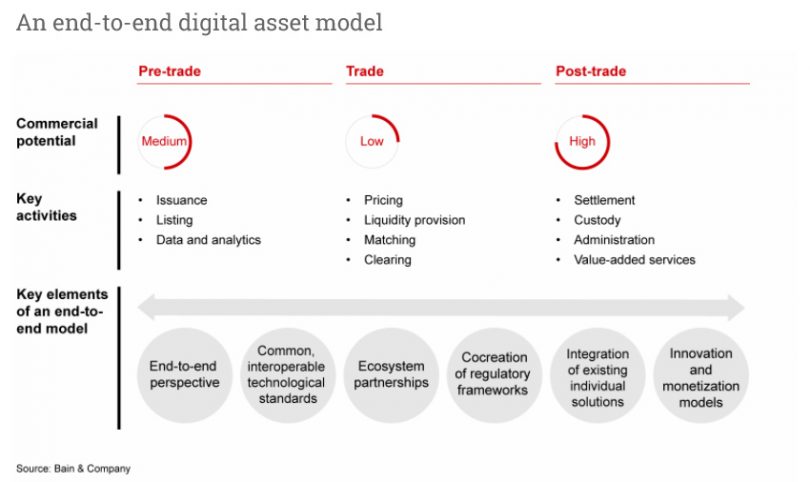

An end-to-end and global approach

Talking to Mike Kühnel, Bain & Co partner and co-author of the report, he described what at first seems an ambitious strategy. He suggests that the infrastructure needs to be end-to-end when addressing digital assets, as in covering pre-trade, trade, and post-trade. Additionally, he is negative about local propositions and prefers a global strategy.

We wondered how this is possible in the current economic climate, never mind the patchwork of disparate regulations worldwide. His response is to develop an ecosystem of partners. Kühnel points to two moves by Japan’s SBI as a signal that others are embracing the concept. SBI inked a deal with Boerse Stuttgart in 2019 and last month unveiled a collaboration with the Swiss SIX Digital Exchange (SDX). And those are just two of SBI’s numerous deals, many of them with startups.

The benefit of the global ecosystem is a higher probability of success as well as the economic payoff. Plus, it reduces both the risk and the costs. Kühnel is personally spending a significant amount of time on this point, including how organizations develop a muscle to work with ecosystems, a skill which he believes very few market players possess.

Regulations are the other issue where a global approach presents challenges and Kühnel has strong convictions on the topic. “It’s not about you waiting for the right development on the regulatory side, and once you feel a sufficient level of comfort, you can act,” said Kühnel. Instead, incumbents need to sit down with the regulator to work on the right potential framework.

So if there’s a way, is there the will?

“The market is currently at the point where some incumbents have not yet fully embraced the digital assets evolution,” said Kühnel. “So they are in a kind of wait and see position. They might have started some experiments with collateral mobility, but they have not yet built a fully-fledged digital assets strategy. Others have already embarked upon that journey and spend significant amounts of money.”

One of the challenges is that the markets don’t yet exist outside of cryptocurrencies.

“There is a very low appetite to invest for five years plus in an endeavor to build up an infrastructure and then hope that revenues are coming in,” said Kühnel. The approach is to have a series of steps with proof points early on. Here cryptocurrency plays a role both as an early way to earn money and move up the learning curve in applying it to the other markets.

Digital assets address different pain points across asset classes

Even with an end-to-end approach, major pain points in a particular asset class are at specific stages. For example, with securities, bigger challenges are in post-trade and hence custody and collateral mobility are high priorities. In the bond markets, the costs of issuance is the predominant pressing issue.

Kühnel emphasized the importance of becoming strong in all three aspects of pre-trade, trade and post-trade to be able to offer customers value-added services built on top. And data is a key service area which some incumbents in traditional markets have not exploited and are still defining their strategy.

And those traditional markets aren’t going to go away any time soon. The existing highly efficient listed equities infrastructure makes this a far less attractive option for digital assets and is another key reason for focusing on private markets. Instead, coexistence is more likely.

Over the last two years, Bain has already seen an acceleration in terms of appetite and interest in digital assets. Some people envision that in ten to 15 years, digital assets might replace traditional markets. “That’s not our belief. However, what we believe is that the relevance of digital assets will exponentially increase,” said Kühnel.