Today digital asset firm Bakkt and Victory Park Capital confirmed the company would list via a merger with Nasdaq quoted VPC Impact Acquisition Holdings. It also announced that Gavin Michael, former head of technology of Citi’s Global Consumer Bank, joins Bakkt as CEO.

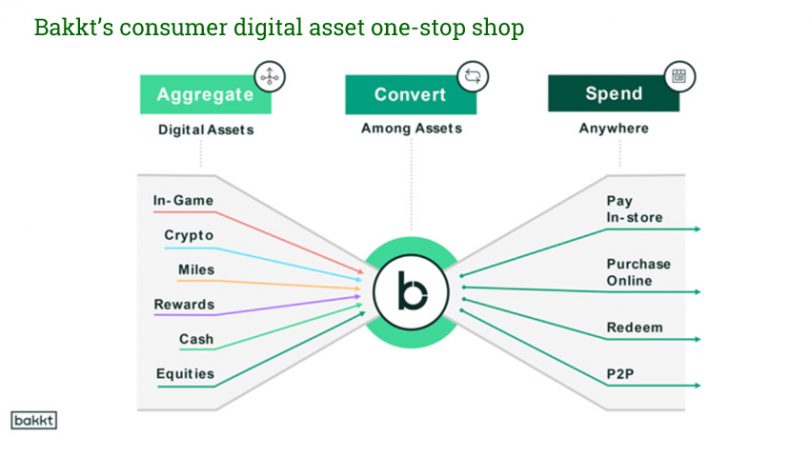

NYSE owner ICE, which founded Bakkt, will have a 65% equity interest post listing (down from 81%) but will retain less than majority voting rights. As previously noted, the key asset is Bakkt’s customer loyalty and commerce app, which digitizes reward points and provides a one-stop-shop for digital assets.

The merged firm has an enterprise value of $2.1 billion, of which $570 million is cash. That includes a simultaneous private equity investment (PIPE) of $325 million, of which $50 million comes from ICE.

Bakkt’s unique selling point

Bakkt’s mission is a compelling one: to target consumers by bringing together digital assets of all types in one place, whether it’s rewards points, in-game assets, cryptocurrency and make them all convertible and usable for payments. So, in theory, you could use your air miles to pay for Starbucks coffee, and Starbucks is an existing partner and investor. The company says that 100,000 users have signed up to its early access app, with another 350,000 waitlisted.

The company’s existing Bitcoin futures application didn’t get a mention in the investor presentation.

During the presentation, Chief Product Officers Nicolas Cabrera said Bakkt’s roadmap was the result of research. “What we heard loud and clear are two main frictions. One is the fragmentation of digital assets today. People realize their own value in the form of points, in miles, in cashbacks, maybe gift cards; maybe they traded some crypto assets,” said Cabrera.

“But to do so, they need to engage in multiple programs, multiple apps, with different logins, different credentials. And because of that, we heard loud and clear from consumers that they felt that they leave value on the table.”

Before we dive into what we believe are significant omissions from the prospectus, don’t get us wrong. We like the high-level concept of what Bakkt is trying to achieve.

But it’s more-or-less a pre-launch startup that is valued at $2.1 billion. The question is whether that valuation is premature. There’s $207 million cash from the SPAC and $325 million from the PIPE which means the pre money valuation is around $1.5 billion. Until now, Bakkt raised $487 million in two rounds, so that’s a more than 200% return for pre-SPAC Bakkt investors.

Bakkt was founded by ICE, which at its core is a B2B company, and this is a B2C venture which has already had a diversion into physical delivery cryptocurrency derivatives.

The critical digital asset rewards question

The unique aspect of Bakkt is it creates a one-stop shop amalgamating cryptocurrency, rewards, payments and more. Of all the questions, one stands out: how many companies have agreed to allow their loyalty points to be converted to digital assets? Because this is an important customer lure. Not all companies will be willing to allow the rewards to be converted to cash because it could devalue them. It will mean a higher proportion will be redeemed, raising the cost of loyalty schemes.

The Bakkt app is fully integrated with Starbucks, an early investor announced at the initial company unveiling back in December 2018. That’s a massive plus. Microsoft’s VC arm was also an initial investor, but there’s no mention of Xbox in-game assets, only Xbox gift cards along with 200 other gift card merchants. Gift cards are relatively simple to integrate.

Eleven months ago, the company spent close to $300 million buying loyalty tech firm Bridge 2 Solution. How many of the company’s 4,500 loyalty and employee incentive schemes have been signed up for the app? Not many.

The presentation mentioned 30+ “view only” loyalty sponsors, including JetBlue, Alaska, Chipotle, Domino’s, and Discover Rewards. In other words, a feed that is relatively simple to implement technically. The critical question is whether these firms have committed to allowing their rewards to be converted into digital assets. We’ve requested confirmation on that point. Bakkt listed partial integrations in travel with Allegiant and Choice Hotels and a partial integration with BestBuy for spending.

So for a $300 million investment, is Bridge 2 delivering fast enough? After all, given the app is not yet fully in production until March, the biggest risk is execution.

Interesting figures

The $570 million in cash is also meant to last the company through to break-even point. Given the company’s past fundraising, we estimate it burnt at least $140 million in cash (apart from Bridge 2) in the two years since its Series A was unveiled. If there were any figures about this, we missed them.

And it’s the figures where we have our biggest reservations. In 2020 its cost of customer acquisition was $15 per user. It expects that to decline to $7 by 2025. Given there’s little competition at the moment, the only justification for that decline is that loyalty partners help it to sign up users. This comes back to the issue of how many Bridge 2 clients have been converted.

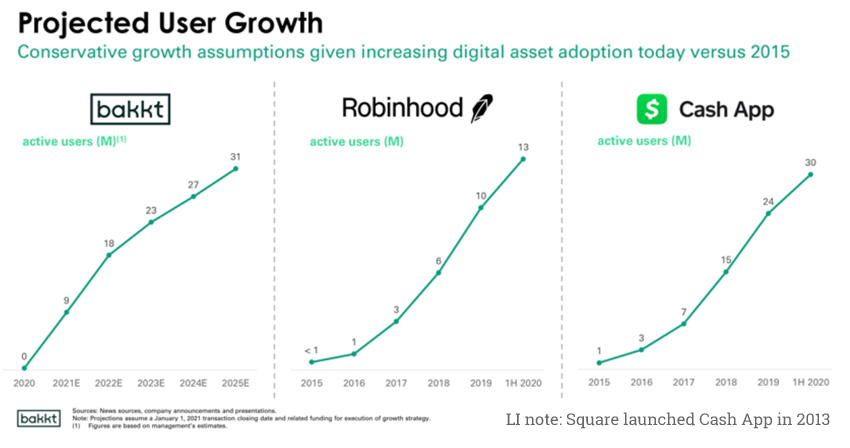

On the topic of acquiring customers, it anticipates 31 million users by 2025, with nine million in the first year. Most tech firms experience hockey stick growth, but that’s not the pattern predicted by Bakkt which shows front-loaded user growth in the first two years.

Another oddity is its rather flat operating expenses, which go from $259 million in 2021 with nine million users to just $320 million in 2025 when it has 31 million users.

But it really comes back to that one question: will Bridge 2 clients be willing to convert their rewards to digital assets. Because that seems to be a key part of Bakkt’s secrete sauce. If not, it will need another pivot.