A Japanese study group on digital currencies has evolved into a larger Digital Currency Forum to explore specific use cases. It aims to explore a digital currency-based settlement infrastructure leveraging the Japanese Yen. The original group of nine firms included SMBC, MUFG, Mizuho and NTT Group. Accenture also participated with several government organizations as observers, including the Bank of Japan and Ministry of Finance. DeCurret was the group’s coordinator.

That group has now expanded significantly to 38 firms. It includes JCB, the card and payments processor, some big insurers, capital markets companies, energy firms, advertising agencies, manufacturers and others.

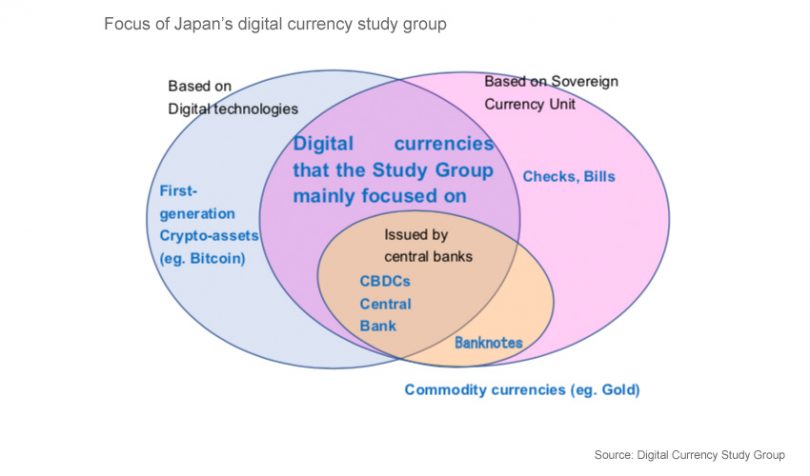

Today the original group published its study paper, which outlined a digital currency diagram, a nod to the famed BIS money flower. A major feature that’s different from the BIS diagram is the absence of a reference to token-based currencies.

The study group concluded they wish to explore two-layered digital currencies, but the terminology does not assume that blockchain will be used. The two layers refer to the value or transaction tier versus the programmability or functional layer. With distributed ledger technology (DLT), there’s a ledger for the transactions and a smart contract layer for programmability. But the study paper referenced neither a ledger nor smart contracts.

That’s quite surprising, particularly because Japan’s earthquake and tsunami resulted in the Bank of Japan exploring how a potential central bank digital currency could be used offline. If a DLT isn’t used, currencies are likely to be account-based rather than token-based, which would be even harder to use offline.

However, what’s more likely is that the study group wants to accommodate digital currencies whether or not they use blockchain rather than assume one form.

Another critical feature is the base value layer will ensure interoperability between the various digital currencies. That’s crucial because there are already numerous private payments initiatives in Japan, and the lack of interoperability could prove problematic long term.

For example, Mizuho is behind the mobile payments initiative J-Coin, backed by numerous regional banks and launched in March 2019. MUFG plans to launch its GO-NET blockchain payment network next year. And SBI initiated the MoneyTap , a Ripple-based payment solution to enable 24/7 bank transfers whic also attracted numerous regional banks. However, SBI is a notable absentee from the study group and Forum. And DeCurret recently announced that Toyota Systems is experimenting with blockchain-based digital currencies.

The Forum plans to implement Proofs of Concept (PoCs) for various use cases as well as create some standards.