Yesterday Nasdaq listed Netfin announced that it completed its ‘business combination’ with Triterras Fintech, the Singapore firm that owns the Kratos blockchain trade and trade finance platform. As part of what is effectively the listing of Triterras as a unicorn, some revenue and other financial details were shared. [Update: Triterras has been sued and is being targeted by short sellers.]

Netfin was a special purpose acquisition company (SPAC) with more than $250 million in cash on its balance sheet. Back in June, when the deal was first revealed, the announcement said that the pre-money equity value of Triterras would be around $670 million and post-money $939 million.

With a current stock price of $12.15 and 83.196 million shares, the merged company is worth slightly more than a billion dollars.

Founded in 2018, Triterras developed the Kratos platform using Ethereum blockchain technology and focuses on digitizing the trade and trade finance processes. The aim is to reduce the inefficiencies and discrepancies that arise from the paper trade process. At the same time, blockchain can help prevent fraud by making it harder to forge paperwork and accelerate the trade finance process.

Tapping alternative sources of finance

The Singapore based company focuses on commodity trade and smaller firms in particular. Triterras EVP Jim Groh told Ledger Insights, “it’s for the SME trader that does $300-$500 million a year with four to fifteen people and would benefit through outsourcing a technology solution and the solution that we bring in terms of alternative lending sources.”

Notably the company says that trade finance does not come from banks but specialist firms. This year it has onboarded ten lenders, including specialist trade finance firms and general credit funds. They have combined assets under management of $17 billion against a projected $2.5 billion of trade finance for Kratos this financial year. The company also points out that because the credit is short term, the actual assets needed are probably closer to $1.5 billion.

“What we are seeing is really a flood of banking capacity leaving the market,” said John Galani, Triterras COO, at a recent investor presentation. “So you have some very, very large banks that have pulled out. The other banks that have supposedly stayed in that market all have moved upwards towards the MNC levels – multinational companies with large balance sheets.” His view is that for SMEs and transactions below $10 million, it’s not worthwhile for the banks.

An alternative perspective was aired in comments to a Financial Times article. The person observed that the numerous trade finance platforms “bundle banks into groups of 4s and 5s” and worried that it was “contributing to the industry’s future by promoting fragmentation”.

Yet another view might be that trade finance is becoming increasingly commoditized.

Impressive figures

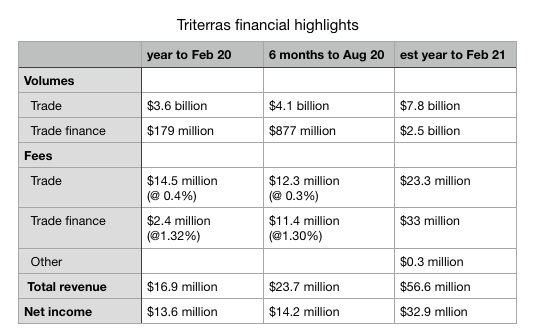

Meanwhile, some of the figures shared by Triterras during investor presentations were quite impressive. Kratos charges 0.3% of the trade value for using the digitization platform and another 1.3% if trade finance is funded via the network. It was noted that Kratos’ fees had already dropped for trade from 0.4% to 0.3%. The explanation provided was that the 0.4% was a premium when users only used the platform for trade and executed the finance elsewhere because Kratos had not yet launched its financing solution.

In the year to February 2020, trade volumes were $3.6 billion and in the six months to August, it processed $4.1 billion. Trade finance is a relatively new add-on, and figures for the past six months are $877 million processed. The revenues earned by Triterras were $23.7 million during the six months with a net profit of $14.2 million.

But the sector is getting increasingly competitive. Singapore has another platform, dltledgers, which has processed more than $2 billion in transactions to date. The komgo commodity trade finance platform has also passed a billion. Then there are the major banking platforms we.trade, Marco Polo and Contour, not to mention numerous others. But apart from some of the big Chinese platforms, Triterras is doing rather well. Plus, it now has deep pockets.

Update: The original article mistakenly included Cargill, Louis Dreyfus Company, Glencore & Gunvor as clients based on a misunderstanding of an investor presentation. It meant to outline the sector, not Triterras’ clients. Also the original piece said 90% of funders were non-banks, but it’s 100%.