Today Singapore’s DBS Bank published a report about digital currencies both pubic and private. The report states that “private payments and private currencies were both seen initially with a degree of dismissive pessimism by central bankers in the past decade; not anymore.”

The paper reviews central bank digital currencies (CBDC), payments, cryptocurrencies and the various roles, including exchanges, derivatives and custodians.

Public and private currencies are here to stay, says the bank. At the same time, physical cash, while declining, is not going away. Nor are sovereign rights over money.

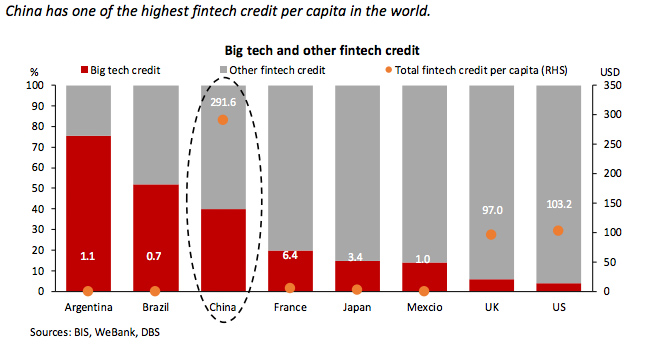

One of the most interesting sections related to China, it’s road to the digital renminbi, and the stats on how Alipay and Tencent have tied up the mobile payments and credit market.

China’s fintech credit market is by far the biggest in the world and the two firms have grabbed more than 40% of it. That contrasts with the next players, the U.S. and U.K., where big technology firms do not yet dominate the fintech credit market.

“CBDC generate transaction data and circulation information that may promote the development of the credit industry, reducing bad debt and risks facing financial institutions, providing an excellent reference for monetary policy formulation,” says the report.

Although DBS hasn’t been so active in the digital currency sector, it is a major participant in blockchain trade finance. The bank was one of the first big users of local trade finance platform dltledgers, which helped it achieve one of the largest trade finance transaction volumes outside of Chinese platforms.

It’s also a member of two blockchain consortia Marco Polo and Contour, as well as the Hong Kong Monetary Authority’s eTradeConnect. Plus it developed a supply chain finance solution for Chinese SMEs. Last year it was one of the first organizations involved in ICC Tradeflow platform based in Singapore.