EY initiated the blockchain marine insurance project which went live with Maersk at the beginning of the month. The first stage of the Insurwave project automates insurance of a vessel’s hull and machinery.

Insurwave is a joint venture between EY and Guardtime and uses Microsoft’s Azure infrastructure. Maersk as the pilot client brought in their insurers and brokers Willis Towers Watson, XL Catlin, and MS Amlin as well as insurance standards body ACORD.

The plan is to provide insurance for more than 1,000 commercial vessels in the first year and to automate more than half a million ledger transactions.

Shaun Crawford, EY Global Insurance Leader, commented: “It is a proud moment for a number of heavy weight industry participants to be live with a genuine end-to-end blockchain platform in the specialty insurance market. All parties have worked extraordinarily hard, as a closely knit team, to get to this exciting milestone. To move from proof of concept just a year ago to a fully functioning platform that is delivering immediate value to clients feels exceptional.”

Talking at this week’s Blockchain for Insurance Summit, Lars Henneberg, A.P. Møller-Maersk A/S Head of Risk and Insurance outlined the rationale for the project.

Maersk’s ambition is to become “the global integrator of container logistics.” They want to create a holistic view of the value chain. For insurance, it’s currently fragmented with different companies insuring trucks, terminals, the vessels, and cargo. Maersk intends to change that.

Business problem

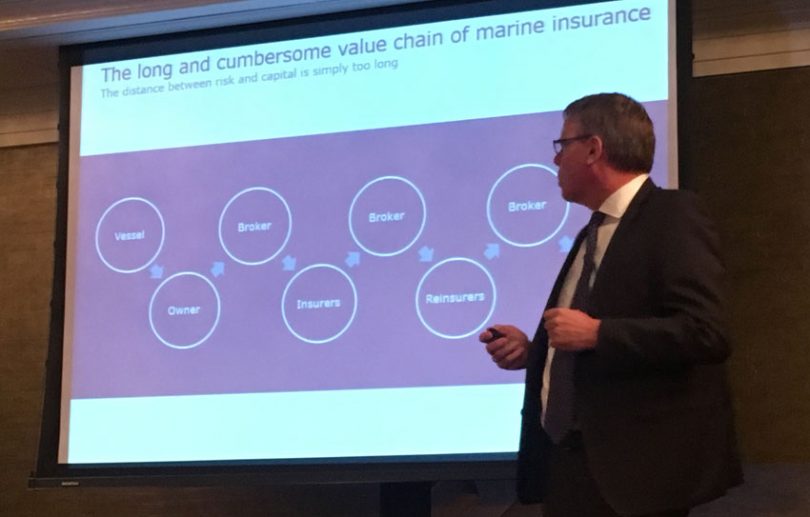

At the Blockchain for Insurance Summit, Henneberg described the diagram above: “Today the way that we basically transfer risk to insurers is a very cumbersome way. There’s a long way from risk to capital.”

“We have the vessel, the owner of a vessel. We go to a broker, they then go to an insurer. They then go to a broker again who goes to a reinsurer that goes to a broker again that goes to a retrocession insurer. A very long and cumbersome value chain. It’s sequential, linear and very frictional.”

More importantly with all these players, much information is lost in translation. And all those intermediaries have to be paid.

Marine insurance started 300 years ago. However, it hasn’t changed a lot. The London coffee houses have morphed into a vast marketplace, but the broker still turns up with paper-based insurance slips to discuss them with the underwriter who signs and stamps them.

“Very antiquated, very inefficient, very costly. And also it creates dissatisfied customers in a dysfunctional system. And when you have that all together then it’s prone to disruption,” said Henneberg.

In Maersk, that’s a large customer. They carry 18% of global trade. Some of their vessels carry 20,000 containers.

Automation

Contrast this image of insurance with the modern high tech marine world. Maersk’s vessels are all connected, so they know everything at the shore in real-time. They can monitor the vessel’s location, the hull, the machinery, the containers, and the cargo. So they have risk data in real-time.

So the question was can they start insuring the risk based on the behavior of the vessels rather than some declaration on a piece of paper?

In the past, it was more about the size of the ship and the value of the vessel and cargo. Now Maersk knows how active the ship is, where it’s going, what load it’s carrying, and they can do it in real-time.

Having automated the vessels now the insurance underwriting can be automated as well. The same goes for claims, policy distribution, invoicing, and payment. On top of that, there’s regulatory checks and the audit trail that comes for free with blockchain.

How it works

When there’s a new vessel in the yard, it’s entered by operations into the database. The vessel database automatically connects to the blockchain platform.

The smart contracts for insurance and reinsurance will rate the vessel and set the price based on the algorithm. Policy documents are automatically distributed to the carriers. Likewise for endorsements and invoices.

Henneberg gave an example of when a vessel enters a zone where the premium needs to change. In the past, there was a cumbersome process. The captain would notify the management department who would inform the brokers who would notify the insurers. Whereas now the GPS will signal the position and the smart contract will issue endorsements and invoices automatically.

A significant benefit is it all happens simultaneously as opposed to sequentially. And everyone sees the single version of the truth.

Next steps

There’s four main types of marine insurance: hull and machinery, cargo, containers, and liability protection and indemnity. Liability includes risks for accidents and staff. The current version of Insurwave focuses on hull and machinery.

Maersk is keen to offer blockchain based cargo insurance as an add-on. Additionally, EY and Guardtime plan to target global logistics, aviation, and energy.