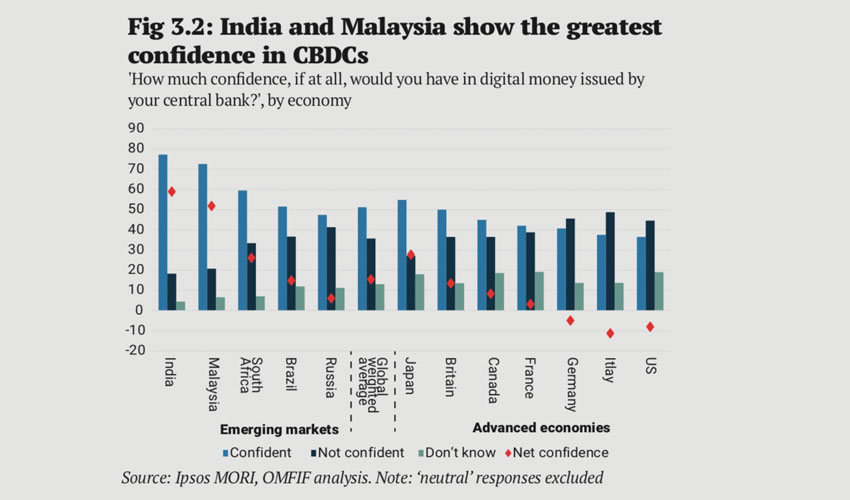

Yesterday the Wall Street Journal (WSJ) published an article about the pros and cons of a U.S. central bank digital currency (CBDC) or a digital dollar. However, recent research by MORI and OMFIF showed that U.S. citizens are not keen.

The survey found that the number of U.S. residents that have confidence in the Fed Reserve as an issuer of digital currency was less than those who are non-believers. The net figure was a negative 8%. Of the 13 countries surveyed, the only state that was more against the idea was Italy.

In the WSJ article, MIT head of the Digital Currency Initiative Neha Narula outlined the advantages of a CBDC. She pointed to the oft-quoted potential benefits of cheaper payments, both domestic and international. And the ability of the Federal Reserve to influence monetary policy.

But the core of her argument was about competition. If the Federal Reserve doesn’t issue one, someone else will (or has already). The network effects of payment systems could stifle competition. This is an argument made by others about Facebook’s Libra digital currency.

Narula stated that a CBDC with APIs (application programming interfaces) could result in novel applications and enhance competition. She also addressed the issue of international currency competition if another country issues a CBDC first.

We’ve previously written about the potential for a digital renminbi to challenge the dollar, something that the IMF’s chief economist thinks is unlikely.

On the other side of the debate was Lawrence H. White, a George Mason University professor and senior fellow of the Cato Institute’s Center for Monetary and Financial Alternatives.

A large part of White’s argument relied on the technical structure, claiming a likely solution would be consumer central bank accounts rather than a digital currency. He didn’t address the other option of a digital currency with private firms providing consumer-facing services. This is the model favored by China.

Based on the account model, the professor stated the government was likely to be more inefficient and unable to provide appropriate customer service compared to the likes of Venmo and PayPal. And he had concerns about surveillance and sharing information with other government departments. Plus there’s the potential to impose negative interest rates across the board.

White argued there are easier ways to speed up payments, a point made by central banks around the world, including the European Central Bank (ECB). One example is to expand banking settlement hours.

An important benefit wasn’t mentioned directly: The potential for a digital currency to address financial inclusion.