On Wednesday, the Financial Stability Board (FSB) Chair Randal K. Quarles, wrote a letter outlining a schedule for recommendations about regulating stablecoins. It treats stablecoins as part of the cross border payments challenge.

The letter was addressed to the Finance Ministers of the G20 and central bank governors.

Facebook’s unveiling of the Libra digital currency in June last year triggered a flurry of activity around the issue. Earlier this week, the EVP of the European Commission, Valdis Dombrovskis, responded to members of parliament questions about the timing of a response to stablecoin regulation, or Libra in particular. The EU is currently conducting a public consultation.

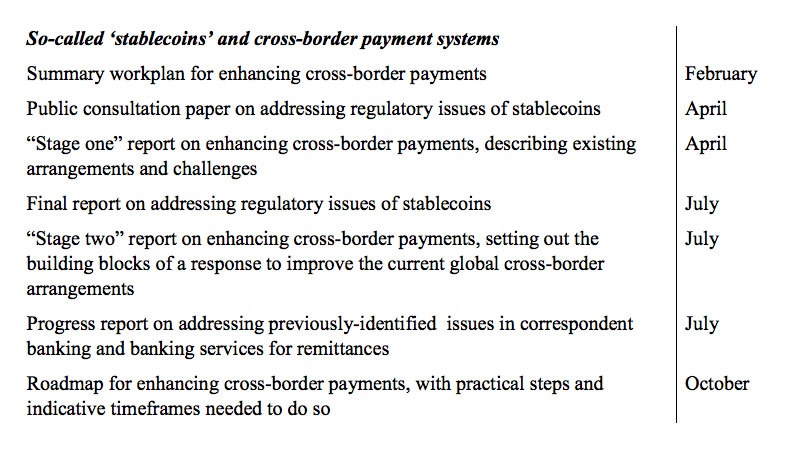

The FSB letter also talks about a public consultation to address the regulatory issues of stablecoins in April. But its final output will be a “roadmap for enhancing cross-border payments, with practical steps and indicative timeframes”.

The end result doesn’t explicitly mention stablecoins. From a central banker perspective, if cross border payments were to become quicker, cheaper and easier, the use case for stablecoins would be narrower. However, unless constrained, stablecoins are likely to develop faster than any co-ordinated government efforts.

The FSB Chair resolved to speed up the pace of response. He said the review of regulative and supervisory approaches was complete and a dedicated working group aims to come up with solutions to address the risks of stablecoins while still preserving benefits.

As can be seen from the schedule, Quarles concludes that cross border payment issues and stablecoins are closely linked. “Digital tokens that aim to be payment substitutes have the potential to become globally systemic, not least because they may fill needs not met by existing cross-border payment systems,” wrote the FSB Chair.

The Saudi G20 Presidency asked the FSB to develop a roadmap to improve cross border payments.