Bain & Co estimates that blockchain can help to increase global trade by $1 trillion over the next ten years. The results were published in a white paper entitled “Trade Tech – A New Age for Trade and Supply Chain Finance“. The World Economic Forum (WEF) commissioned Bain & Co to identify how Fourth Industrial Revolution technologies can help facilitate trade in the future.

Global trade is bogged down by a considerable amount of manual paperwork which is slow and expensive to process.

Bain & Co estimates that if it’s possible to reduce border administration and improve telecom/transport infrastructure, global GDP could rise by 5%. That would compare to a boost of just 0.7% if all global trade tariffs were removed. The consultants also published a blockchain trade finance report a few months back.

One way to reduce border administration is if a country develops a single point of service for importers and exporters. That avoids companies having to chase around different departments. When Senegal implemented a single window, they reduced processing time by 90% from a two-week average down to just one day. And Senegal’s costs dropped by 60%.

Trade finance

Generally, import/export finance is split into three. Supply chain finance allows buyers to extend how long they take to pay, freeing up capital. Trade finance generally benefits the supplier. Letters of credit guarantee that suppliers get paid on presentation of documents, usually delivery. But it’s a time consuming and paper-heavy process. And open account trade finance includes trade discounting and factoring, where suppliers sell to customers on credit but get their invoices paid earlier.

Bain estimates that demand for supply chain finance is growing by 5-15% a year in the Americas and Western Europe, and by 10-25% in Asia.

In 2017, the Asian Development Bank estimated there was a $1.5 trillion trade financing gap which is about 10% of global trade volumes. 75% of this unmet demand for trade finance comes from SMEs.

Benefits of DLT

Many of the blockchain benefits from trade finance come from digitalization. Bain estimates that 50%-60% of trade finance revenue goes to cover costs. Distributed ledger technologies (DLT) enable information to be confidentially shared between trading parties and financiers. Because the data is shared, it avoids the cost of reconciling between buyer, sellers, and bank.

The net effect is it’s quicker and easier to do credit risk assessment based on transaction history. DLT avoids human error in manual document checks. Plus the business processes are automated using smart contracts. As a result, there’s an instant, secure and low-cost exchange of data.

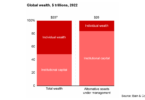

Bain defined traditional trade as regular payment of invoices plus letters of credit. In the next seven years, Bain estimates 40% or $0.9 trillion of traditional will move to DLT for better service levels and lower fees. Additinally, they predict about 30% or $1.1 trillion of new trade volume will result due to DLT removing barriers.

Examples of trade finance blockchain

In Europe, a consortium of banks supported by IBM has gone live with we.trade. This is an open account trade finance platform targeted at SMEs. Another IBM initiative is Batavia with five banks. R3 and TradeIX have a Marco Polo consortium of banks, and R3 is also involved with the Voltron project for digitizing Letters of Credit.

At a government level, both Hong Kong and Singapore have trade finance DLT initiatives and are planning to connect the two. Hong Kong’s platform should go live later this month. The BRICS nations have also started to explore trade finance jointly.