Earlier this week, U.S.-based asset management firm State Street published a report on 2020 industry trends, which sees growth in digital assets and blockchain for financial markets.

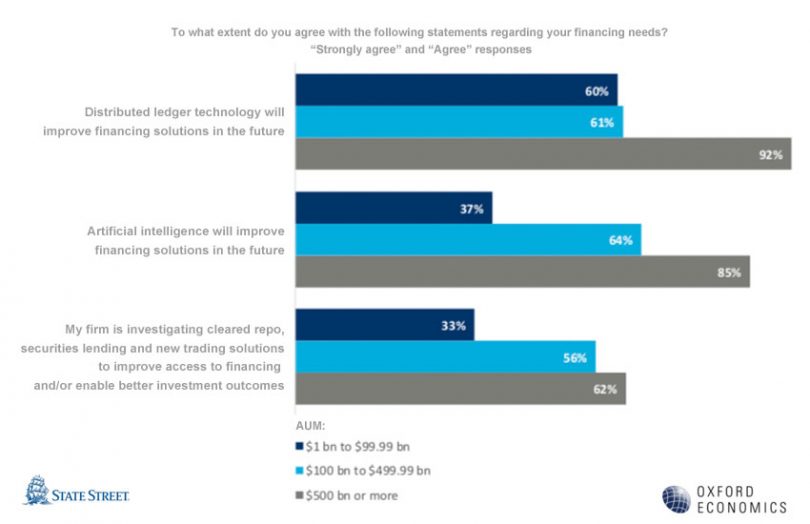

The report is based on a survey of 101 North American asset managers with an emphasis (71%) on those with more than $100 billion in assets under management (AUM). About 65% of the respondents agreed or strongly agreed that distributed ledger technology (DLT) is likely to improve future financing solutions. But in the case of larger asset managers, with more than $500 billion under management, the figure was 92%. That said, large asset managers only made up 13-14 of the people surveyed.

And 62% said DLT would be integrated into their trading process in 2020.

The survey also explored the penetration of digital assets in the sector. It found that 94% of respondents already hold digital assets or crypto-funds. A similar trend to DLT was observed here, where 69% of larger asset managers said they plan to increase their allocation for digital assets. That compared to a 38% figure across the board, and 45% of all asset managers plan to maintain their current weighting.

“It’s an exciting time for technology and innovation in the industry, and ultimately investors will benefit from new technologies and a wider range of choices for constructing portfolios,” said Nadine Chakar, global head of State Street’s Global Markets business unit.

A majority of respondents are bullish on the relatively new type of investment portfolio. About 62% said that tokenization would improve risk management of traditional financial assets, which was the largest benefit cited. Joint second at 55% were enhancing security with tokenization and improved transparency. Only 4% said they don’t see any benefits from tokenization.

Despite the positive outlook, 55% of asset managers believe tokenized assets carry inherent risks that are too big for widespread institutional adoption. On the other hand, 45% believe tokenization of traditional assets will be a massive market disruption in the next five years.

Below are recent blockchain surveys:

Accenture: blockchain for aerospace

Boston Consulting Group: blockchain for transport and logistics

Cap Gemini blockchain survey

Deloitte 2019 blockchain survey

Deloitte 2018 blockchain survey

EY blockchain (finance and tech professionals) survey

EY fintech adoption survey

EY APAC blockchain survey

IDC semi-annual enterprise blockchain forecast

IHS Markit survey

KPMG technology industry innovation survey

PwC blockchain survey

PwC China blockchain survey

World Energy Council / PwC blockchain survey

SAP blockchain survey

TD Bank payments industry survey

BNY Mellon payments survey

Friss insurance survey

Juniper enterprise blockchain survey

BIS Central Bank Digital Currency survey

IBM / OMFIF Central Bank Digital Currency survey 2018

IBM / OMFIF Central Bank Digital Currency survey 2019

ING general population cryptocurrency attitudes