Today bank-backed blockchain firms Fnality and HQLAᵡ announced they completed end to end testing to enable intraday repo settlement. They plan to allow trades on the Eurex Repo F7 system to settle via the two blockchain networks, with a production launch scheduled in Q4, subject to UK regulatory approvals. Fnality is the UK-regulated systemic payment system that went live in December and HQLAᵡ operates its Digital Collateral Registry to enable intraday collateral movement.

The key advantage is the ability to settle trades at a specific time of day, enabling institutions to execute intraday repurchase agreements (repos) and have granular control over their liquidity. In conventional repos, the collateral settlement usually takes two days. For example, UK gilts can be lent in exchange for cash, and the transaction is reversed days later.

Simone Cortese, Fnality’s Director of Product Management, described the benefit to Ledger Insights. He gave the example of loaning out some collateral, “getting into these repos at 8 AM in the morning, closing them at 2 PM. That’s an unprecedented level of control of that collateral and cash management. That’s really the vision.”

The UK repo market is almost as large as the EU’s. In 2023 the average weekly outstanding balance was GBP 8,240 billion ($10.45 trillion), with GBP 1,716 billion in daily trades, according to the London Reporting House.

Blockchain interoperability trials

In late 2022, the first proof of concept was executed between the two platforms. Cortese described that as the cornerstone around which a building has now been developed to reach the latest simulated end-to-end settlement trial. This is the sort of proof that regulators need to see. HQLAᵡ also performed a separate trial with JP Morgan and WeMatch, with a different interoperability solution, Ownera’s FinP2P.

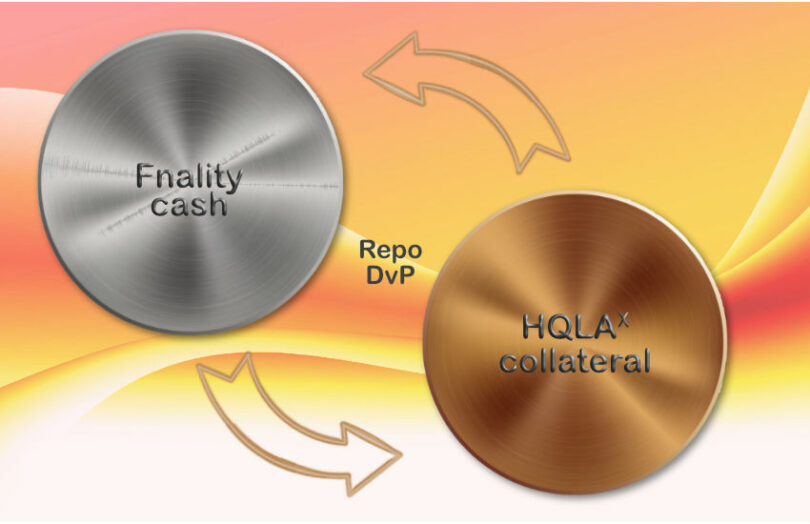

In all of these trials, the key is the interoperability between entirely separate blockchain networks. The collateral stays on the HQLAᵡ platform with the ownership simply changing. Likewise, the Fnality settlement tokens remain on the Fnality platform but are transferred from one participant to another. The critical element is the ability to enable delivery versus payment (DvP) at a precise time.

That works by the collateral getting earmarked on the HQLAᵡ network that uses R3’s Corda enterprise blockchain, and the cash is earmarked on Fnality, which uses an enterprise version of Ethereum. Once the contractual obligations are fulfilled, the ownership changes on both platforms atomically.

The interoperability is enabled through the Fnality Atomic Settlement Protocol (ASP), which uses Enterprise Ethereum Alliance (EEA) standards. Fnality, its technology partner Adhara, R3 and HQLAᵡ have all contributed to the open source Hyperleder Harmonia interoperability protocol.

Other Fnality developments

In other Fnality news, while the company launched late last year, the Bank of England put limits on its operations. For now it has only done interbank payments. Repo is one avenue for expansion. Another is foreign exchange or payment versus payment (PvP), which has always been planned. Plus, Fnality previously ran trials with Finteum, the FX swaps startup.

Finality is in ongoing discussions with US regulators about the potential to launch there, following the DTCC investment last year. However, Fnality would need a central bank account.