State Street unveiled a survey of 2020 industry trends. A small part of the report relating to digital asset custody highlighted divergent views about what sort of organization might provide this service.

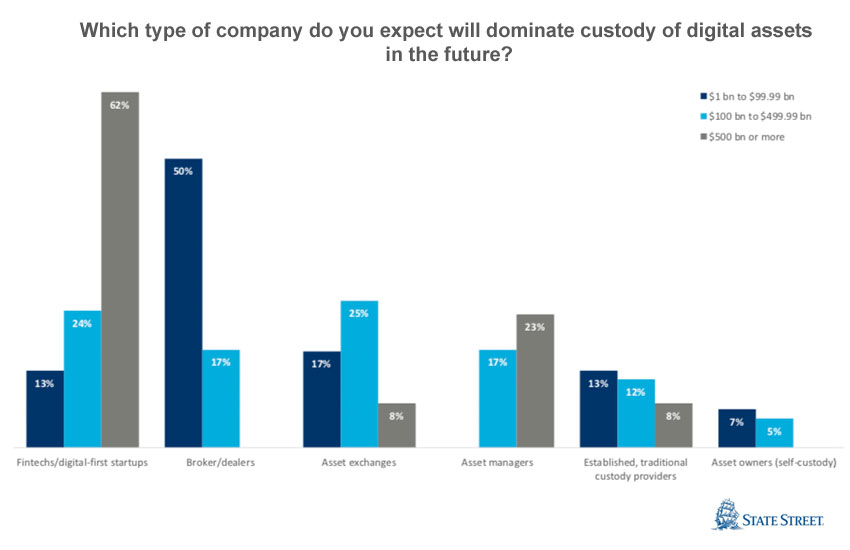

A very significant proportion of larger institutions (62%) believe that fintechs will lead the way. In contrast, 50% of smaller asset managers think that broker-dealers will provide custody, compared to none of the larger firms holding this view.

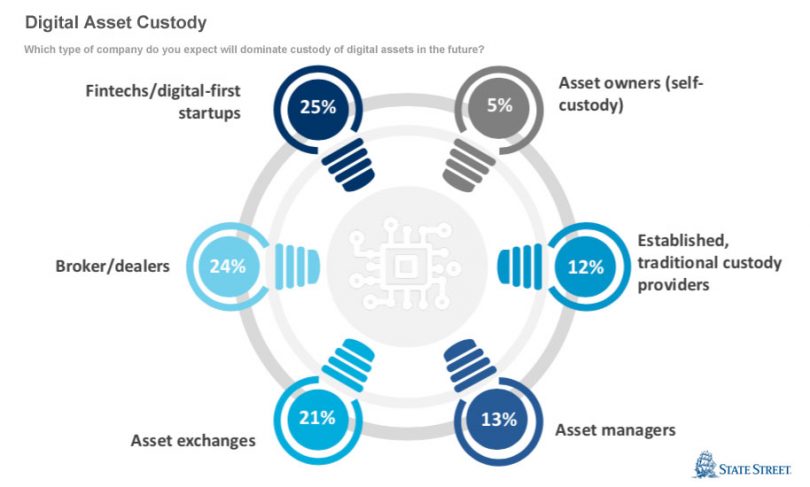

Across the board, only 25% anticipate that fintechs and startups will provide custody services, the survey predicts.

Digital asset custody fintechs

So who are those fintechs? There’s already a handful of potential players.

From the very beginning, London based Trustology made clear its focus was on institutional digital assets, even if it initially dealt with cryptocurrency to get off the ground. Former bankers from UBS and BNY Mellon started the firm.

But since its unveiling, there’s increasing competition from the likes of US-based Anchorage where the founders previously worked at payments startup Stripe. Anchorage is also a Facebook Libra participant.

And in Switzerland, there’s METACO which says its SILO solution is used by Avaloq, Swisscom, Deutsche Börse and Gazprombank.

Market moves

Meanwhile, it’s worth exploring the survey results based on happenings in the marketplace, outside of the crypto sector.

Just yesterday, it was revealed that ING is likely working on a technology solution for digital asset custody.

The survey paints a gloomy picture for incumbent custodians.

Digital assets unquestionably will have a significant impact on the custodian sector as well as registrars. For example, the fact that the asset has been borrowed or lent can be recorded together with the asset, while still achieving real-time transactions.

Last week Deutsche Börse and HQLAX launched a digital collateral registry solution. It features a trusted third party run by Deutsche Börse to sit between the collateral registry and the custodians. One has to wonder what that solution might look like with a digital asset future.

So we asked Trustology about their vision of the registry – custodian split in a digital asset future. “(The) Registry today usually only registers the custodians. Custodians register brokers. Brokers register individuals,” said Trustology CEO and Founder Alex Batlin. “Going forwards they will not merge – Blockchain becomes the registry but collapses the registries into one. Custodians look after keys.”

Will fintechs or incumbents be the custodians of the future? Only time will tell.

The article was updated with a quote from Alex Batlin