This paper discusses the opportunity to introduce decentralized finance (DeFi) lending into the Public Private Partnership (PPP) market.

The global PPP market is vast and growing steadily, particularly in emerging countries where access to public funds are limited. To give some sense of the size of this market globally, here are some statistics.

- Since the 1990s, 1749 PPPs worth a total of €336 billion ($398 bn) have reached financial close in the EU alone.

- Approx $43 billion has been invested in the Philippines since 1994. Other SE Asian countries, such as Malaysia, Thailand, and Indonesia, have received similarly significant investment sums.

- In 2019 investment in the US PPP market reached almost $90 billion.

PPP encompasses a wide variety of different project structuring solutions to deliver major infrastructure projects in which the public and private sectors collaborate under long term agreements. Examples include toll roads, rail, airport, power and water. A typical project ranges from $200 million upwards into the multiple billions. The PPP term often called the ‘concession period’, is generally between 20 and 30 years. That usually comprises an initial investment and construction period at the outset, which is often 2 to 4 years, depending on the size and complexity of the asset being constructed. It’s followed by an operational period, normally upwards of 15 years. This involves the private sector party operating and maintaining the asset and receiving revenues through either end-user payments (tariffs) or direct government payments.

The current state of play

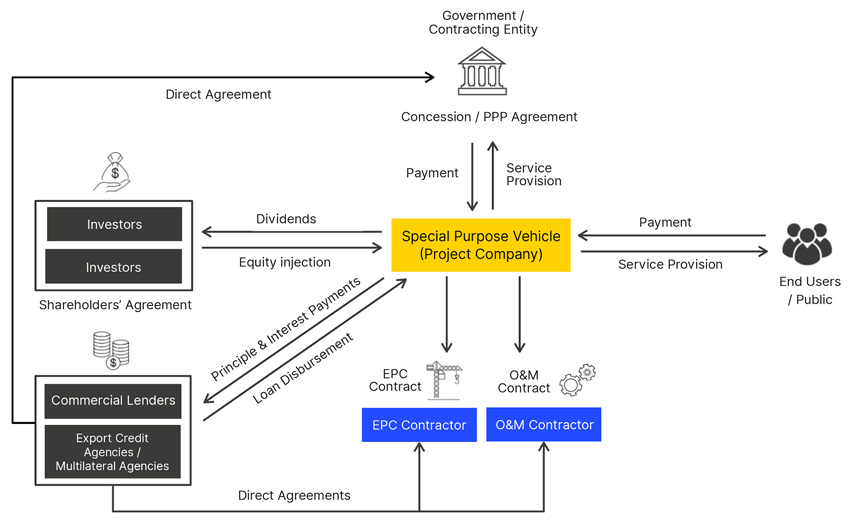

The private player is often a consortium of companies that typically finances the projects through a combination of equity and debt. Equity is provided by the investors in the project, whereas debt is lent on a limited or non-recourse basis by financial institutions such as commercial banks, export credit agencies or multilateral and donor agencies such as the World Bank, EBRD, ADB. Debt can be further divided into Senior Debt and Junior or subordinated Debt, with different tranches having different borrowing costs, depending upon the seniority of the tranche and the relative risk profiles and repayment terms. Debt repayment terms and conditions can vary significantly from project to project, ranging from 5 years up to 25 to 30 years. Structures such as hard and soft mini-perms of 3 to 5 years have become the norm in many jurisdictions. Long-term debt is currently more scarce compared to before the 2008 financial crisis.

The internal rate of return (IRR) that an investor in an infrastructure concession seeks can also vary significantly, with returns as low as 8-9% in some cases, and as high as 20% in other cases. Target returns are calibrated by potential investors based on numerous risk factors including but not limited to country risk, credit risk of the offtaker or counterparty, revenue model (end-user versus bulk offtake / government availability payment), technology risk, project complexity risk, Sponsors and subcontractors profiles, etc.

On behalf of the bidding consortiums and government, the risk profile is studied deeply at the outset of a project during the preparation phase with legal, financial, economic, and engineering advisors all producing key elements of a study which forms the basis of decision making for the investment. Lender’s advisors act on behalf of the financers to perform due diligence on any investment and provide further advice on optimal lending parameters.

Bringing a new suite of financial institutions and products into the PPP market may help drive competition in a market dominated by traditional lenders and multilateral agencies. This could result in increased liquidity and more favorable lending rates for developers, leading to an increased number of PPP infrastructure projects being undertaken. Ultimately this could end up benefiting the wider economy of the host country.

Opportunity

The combined emergence of blockchain-enabled toll roads and other infrastructure projects with DeFi lending brings with it the opportunity to draw upon cryptocurrency investment for financing major infrastructure projects. DeFi lenders could become involved in two ways. Firstly they could provide part of the debt usually provided by commercial banks, export credit agencies or multilateral and donor agencies. Alternatively, they could become a direct investor within the Project Company and provide equity. As mentioned earlier, both options offer different risk/reward structures that are explored deeply during the project preparation phase.

The basic mechanics of lending through DeFi within the crypto community are already being demonstrated well by the likes of Maker DAO, Aave and Compound. Building a segway to fund traditional infra projects is relatively simple compared to the work already undertaken to build the technology.

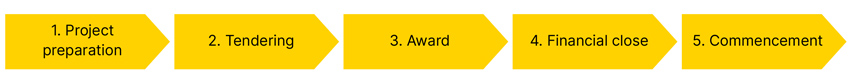

If a DeFi organization wishes to provide equity into a project, it would most likely involve becoming a direct member of the Project Company. These consortiums involve Infrastructure Developers and other key parties, depending on the requirements of the project. The process of winning a PPP project is generally the same in most countries and the main steps are illustrated below.

This can be a somewhat long process that carries a cost due to the extensive amount of work that goes into preparing a PPP, tendering, and reaching financial closure. But the rewards can be quite attractive, as mentioned earlier, with potential IRRs of 20%.

On the other hand, if the DeFi organization wishes to provide debt, the process is much shorter. In this instance, the DeFi company would enter the project at the same time as other potential lenders during Award and Financial Close phases. At this point, the potential lenders will procure Lenders Advisors to review the project feasibility and make an assessment of what is a reasonable level of debt versus the perceived risk and reward associated with the project.

There is no guarantee that the offer provided by the Lender will be accepted by the Borrower (Project Company). Numerous factors such as lending rates, amount of funding needed, and guarantees all play a role in the decision-making process of the Borrower.

Looking ahead

At the most attractive end of the scale from a technology perspective, imagine a major Infrastructure Developer that has a range of assets within its portfolio – rail, toll roads, hospitals, airports, power, and water. The Infrastructure Developer could introduce a stable coin (a token backed by an exchangeable commodity to prevent erratic fluctuation), let’s call it “Infra Token,” which could be deployed across the whole suite of assets. A single token is used to capture all transactions, which would vastly reduce the accounting effort needed. The token would drive increased customer retention in the same way loyalty points in a coffee shop might. As income is generated from the tolls and paid for using the Infra Token, a fixed percentage each month is automatically converted into the DeFi lender’s currency to repay the original loan. Ben Sheppard, Managing Director, TX Tomorrow Explored

Ben Sheppard is Managing Director, TX Tomorrow Explored

James Cook is Head of Advisory, Tribe Infrastructure Group